Blofin Whales’ View: War, Gold and Crypto

The rise in global uncertainty is one of the main reasons for the recent continuous improvement in the liquidity level of the crypto market, and it is also an important reason for the recent strong performance of BTC.

Due to the lack of safe-haven properties, the performance of non-BTC cryptos depends more on the changes in macro liquidity and the game status of on-site funds.

Altcoins have got some advantage in the liquidity competition with ETH, which has further adverse effects on the performance of ETH.

A Bull Market in Geopolitical Crisis

After last week’s non-farm payrolls and employment data were released, “lower-than-expected interest rate cuts” seem to have gradually been accepted by investors and priced in.

This week, many central banks, led by the ECB, will also announce their latest interest rate decisions. Although Europe has performed much better than the US in terms of inflation and the ECB has shown higher interest rate cut expectations, considering that the influence of the ECB is relatively weak compared to the Fed, it can be determined that the speed of global cash liquidity returning to the risk asset markets will slow down in the future. For the crypto market, the bull market may be more “gentle and lengthy”.

However, this does not seem to be the case. Since the beginning of April, the return speed of internal cash liquidity in the crypto market has significantly accelerated. In the past week, the entire crypto market has obtained nearly $3 billion in cash liquidity, and the overall cash liquidity scale has also returned to the level of the same period in Q3 2022. Affected by the above situation, the prices of BTC, ETH, and altcoins have all received strong support, and market sentiment has also significantly recovered. What caused the abnormal changes in cash liquidity?

Let’s take a look at the performance of other assets together. While BTC reached a new all-time high, the price of gold rose by more than 25% in 6 months, also breaking through a historical high. At the same time, the prices of silver and copper also reached their highest point in nearly a year. The rise in gold prices is usually related to safe-haven sentiment. As a long-standing “hard currency”, gold is a vital hedging means when macro uncertainty rises, especially during geopolitical tensions.

However, things become interesting when we also observe the price trends of silver and copper. Silver and copper are essential military and strategic materials closely related to weapon production and the defence industry. Therefore, to some extent, the rapid rise in silver and copper prices is an additional reflection of geopolitical conflict and macro uncertainty risks.

So, are there more similar clues? Of course! Since the beginning of 2024, crude oil prices have risen by more than 20%, and the prices of strategically important commodities such as coffee have soared due to increased demand and supply chain tension caused by geopolitical crises.

The safe-haven sentiment is never reflected in just one asset; when uncertainty comes, people will exchange their cash for “safe hard currencies” or materials, which is an important reason for the rise in prices of commodities such as gold, crude oil, and coffee, and of course, one of the reasons for the increase in prices of cryptos such as BTC.

BTC: Continuing to Rise?

Considering the escalating geopolitical tensions in the Middle East and Eastern Europe, it is difficult for global investors’ safe-haven demand to be effectively alleviated in the short term. Therefore, the safe-haven sentiment will strongly support the demand for BTC. At the same time, although the speed of liquidity return is expected to slow down, liquidity tightening is unlikely to happen again. Therefore, the liquidity scale “locked” in spot BTC ETFs will remain relatively stable. In the long run, the return of liquidity in the future will also push BTC prices steadily up.

Traders in the options market also hold similar views. Although investors’ intraday bullish sentiment has weakened due to short-term fluctuations, investors’ bullish sentiment towards BTC remains stable and dominant in both front and far months. However, investors’ expectations for BTC’s medium and long-term performance have slightly decreased compared to the same period in March, and the weakening of interest rate cut expectations may be one of the reasons.

Based on the latest gamma exposure distribution, with the end of the “Asset allocation period”, the price of BTC seems to have shown some signs of stabilization. The price of BTC can receive some support around $63k-$65k. However, if the price of BTC further rises, it will encounter some resistance around $74k, which will significantly increase as the price rises.

It is worth noting that the latest implied volatility data shows that traders still maintain a relatively cautious attitude towards the price performance of BTC. Facing the upcoming BTC halving, although the macro uncertainty level is relatively low and the pricing for tail risk levels has also fallen, traders still expect that the 7-day price movement range of BTC price may reach 9.27%, and the 30-day price movement range may reach 20.74%.

Considering that investors’ bullish sentiment is still high, the price of BTC still has the potential to break through $80k in an ideal situation. However, volatility is never one-way; we cannot ignore the possibility of BTC falling below $65k.

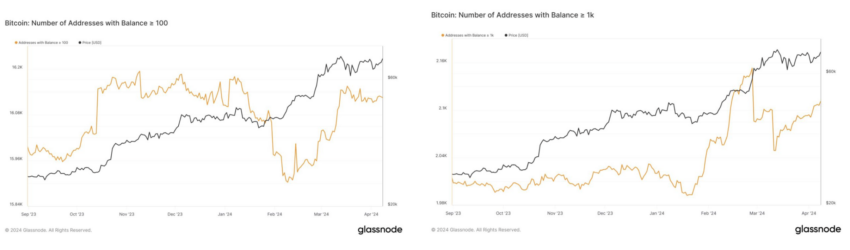

Traders’ caution seems to be justified. In the spot market, although the number of whales holding more than 1k BTC is still increasing, overall, the growth of whales holding more than 100 BTC is stagnating, which means the purchasing power is weakening. Overall, although holding BTC is still a better choice in the medium to long term, with the temporary end of the “asset allocation period”, the price increase of BTC may gradually stabilize.

Non-BTC Coins: Internal Game

Compared to BTC, ETH is not so lucky. The probability of spot ETH ETF passing is gradually becoming slim. Even the most optimistic ETH investors have gradually accepted that negotiations and games around spot ETFs will be long-term. ETH’s performance depends more on the reallocation of liquidity within the crypto market and changes in macro liquidity levels within the crypto market.

From a macro perspective, benefiting from the expectation of interest rate cuts, traders still maintain a bullish attitude towards the long-term performance of ETH. However, similar to BTC, the weakening of interest rate cut expectations has also negatively impacted ETH’s future performance expectations, which is reflected in the changes in the ETH futures’ annualized premium.

Although investors have priced in relatively higher price changes for ETH (9.94%/7 days, 21.5%/30 days), from the perspective of the latest gamma distribution, investors are more likely to worry about fluctuations caused by price declines rather than fluctuations caused by rises. If the ETH price shows a downward trend, it can only gain some support after it falls to around $3,300.

At the same time, compared to the resistance in the upward range, the support on the downward path appears “insignificant”. Unless there are enough positive events under the current market operation mode based on “liquidity reallocation”, the hedging behaviour of market makers will make it difficult for the price of ETH to break through and stabilize above $3,700.

Fortunately, ETH whales seem to have slowed down their selling of spot goods. Under the influence of projects such as Ethena, staking spots for profit has become a relatively more profitable business, and the traditional covered call strategy has also gained favour again as the price rise slows down. However, this only means that whales are temporarily “neutral” in the price game.

For speculators, it seems more appropriate to invest in other coins with more potential for growth when the ETH price is weak, which has further adverse effects on the performance of ETH. The market share of ETH once fell below 16%; although it has recently recovered, compared to last month, the market share of ETH has still significantly shrunk. Considering that the market share of BTC has not changed significantly in the past month, it is evident that altcoins have got some advantage in the liquidity competition with ETH.

Overall, holding ETH is not a “bad strategy”; for whales, the rich interest-bearing channels of ETH can still bring relatively stable and considerable returns. However, for warriors seeking breakthrough returns, considering the current leverage level and relatively low speculative sentiment of altcoins reflected by funding rates, following the pace of liquidity reallocation in the crypto market seems to be a more appropriate choice.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Comments are closed, but trackbacks and pingbacks are open.