Chainlink (LINK) Bullish Rally May Lead to Imminent Correction

Chainlink’s (LINK) price broke out of the consolidation and marked a monthly high of less than a week.

However, this may lead to LINK holders moving to sell their holdings before they lose the chance to secure their gains.

Chainlink Investors May Book Profits

Chainlink’s price is $16.8 after rising nearly 30% this past week. However, this resulted in the altcoin hitting saturation, historically synonymous with corrections.

This is evident in the Relative Strength Index (RSI). RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

Currently, the RSI is above 70, suggesting LINK is overbought on the 12-hour chart. This happened last in February, after which the rally took a break. The same could be the fate of Chainlink’s price as well.

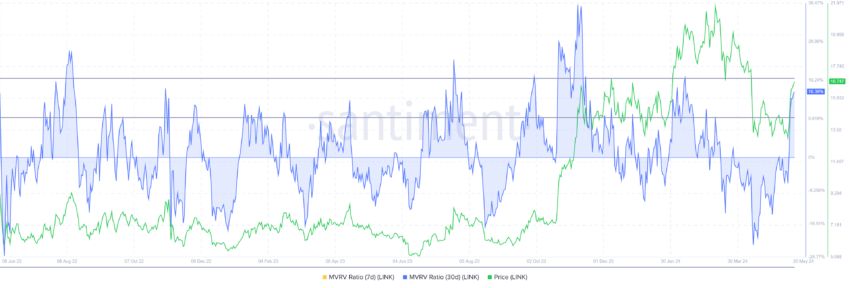

Plus, it could face additional discomfort from its investors should it move to sell, which is a probable outcome. This is because the Market Value to Realized Value (MVRV) signals profit-taking.

The MVRV ratio tracks investor gains/losses. Chainlink’s 30-day MVRV of 16% suggests profit, possibly prompting selling. Historically, LINK tends to correct at MVRV levels of 10%- 20%, labeling this a risky zone.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Such is the situation with Chainlink; investors could move to secure their gains, signaling a drawdown.

LINK Price Prediction: Return to $15 Likely

Chainlink’s price, trading at $16.8, breached multiple resistances to push past the resistance at $16.5. Closer to $17.0, the altcoin is noting a major rally. However, this push that brought LINK to a monthly high could also cause a decline.

Should the aforementioned conditions turn out to be true, Chainlink’s price could fall back to $15.0. Once the support at $15.6 is broken, this would happen, possibly extending the decline to $14.4.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if the investors do not move to sell and the rally continues to rise, Chainlink’s price could continue to rise. Crossing $17.5 would invalidate the bearish thesis, pushing LINK towards $18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Comments are closed, but trackbacks and pingbacks are open.