Pre-token markets can revolutionize interactions with financial instruments: Keyrock report

Share this article

Pre-token trading platforms are still an unpredictable market for buyers and sellers, according to a recent Keyrock report. Despite offering early access to tokens before they launch, data gathered by Keyrock suggests few buyers find profits in these platforms.

Nevertheless, the speculation around the token price serves as a crucial barometer for initial market reactions and investor mood. In cases such as JUP and W, the price after the token generation event (TGE) showed substantial convergence with the pre-market prices.

However, not all tokens behave like JUP and W, as some display significant price variances, the report shows. Notably, Whales Market often commands a premium over AEVO or Hyperliquid.

Moreover, pre-token markets diverge in trading activity, which may lead to inconsistent price prediction.

“Trading a token before its official launch is a pioneering idea. Yet, if pre-token markets occasionally struggle to agree on the correct price, can they truly forecast post-TGE prices accurately? This raises critical questions: can these markets be trusted, and are they genuinely efficient?,” the report highlights.

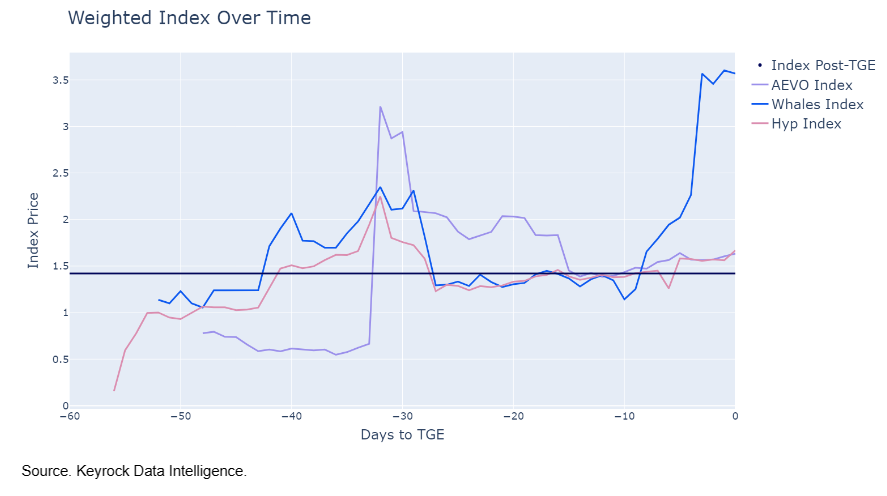

To track the post-TGE activity, Keyrock created index prices that uses market caps as weights to determine an average. In essence, the pre-TGE index price should converge post-TGE. They analyzed trading activity on AEVO, Hyperliquid, and Whales Market for ALT, DYM, ENA, JUP, Pixels, Portal, STRK, TNSR, and W.

Keyrock analysts explain that the navy blue line displayed in the image above tracks the index price post-TGE, acting as a benchmark. and it should align with the pre-token market index price over time.

Although AEVO and Hyperliquid indexes converge close to the TGE, the Whales Market line shows a dramatic spike just days before TGE, likely fuelled by a palpable wave of “fear of missing out.”

“These observations offer more than mere data points; they provide profound insights into the emotional and psychological dynamics that drive market behavior pre-TGE. Understanding these is crucial for anyone looking to navigate the volatile waters of pre-token launches.”

The report then finds out that the market landscape does not favor a consistent set of winners, as both buyers and sellers can realize significant gains depending on their timing.

Another common characteristic of pre-token markets is the points system, which consists of users selling their points used to qualify for airdrops. The report finds a lack of correlation between price movements and these points in pre-markets.

“Blast and Parcl, for instance, exhibit unique trading patterns in their token prices that do not mirror their points markets. This disconnection underscores a broader issue: the glaring lack of liquidity that obstructs genuine price discovery, resulting in volatilities that are 10-20 times higher in pre-token markets than those seen post-TGE.”

Yet, even with the flaws identified by Keyrock, they still see this as a “development that isn’t merely captivating for the industry,” with the potential to reshape the wider financial landscape. The possibility of trading assets before they truly materialize can revolutionize the way investors interact with financial instruments, concludes the report.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Comments are closed, but trackbacks and pingbacks are open.